Someone argues woes about deflation especially in Switzerland are overstated as skepticism focuses on bad effects mainly. They suggest, however, Swiss is experiencing a good deflation during a long period. Switzerland has no evidences of bad deflation such as recession, lower pressure of wage, rising debt burden.

In this thought, some conditions are given. These are 1) monetary easing policy could not enhance inflationary pressure for nowadays, 2) monetary easing including purchasing bonds is better than doing nothing to boost real-term economic indicators as a member of ECB argued yesterday, and 3) as they say, nominal indicators should not be deteriorated.

The last condition is the most important, I think. In fact, in a economic text book, that condition is not deflation, but disinflation merely. Draghi, the president of ECB, appears to aim at this good deflation, not inflation. As I noted previously, ECB's easing almost lead to press oil price to lower and this could push the inflation rate toward lower. If then, Draghi must believe this environment of inflation is not deflation, but only disinflation. And so, it's clearer he wants to follow FED's previous steps.

Yes. It's a kind of massive experiment of monetary policy no one knows where is the end. That's maybe why Euro has devalued and bond rates have tumbled against USD and UST.

Draghi may have wanted to continue or expand QE until many criticize QE is not working tool.

Last night, FOMC commitment was very hawkish and bond market players seemed frightened.

As I posted yesterday, it looks like Ms. Yellen starts to lead other core members to boost economic sentiments and decrease uncertainty by suggesting clear signal of tightening.

What is risks?

1) One is the case this is the deflation explicitly, not disinflation. In this case, real-term economic indicators improvement turns meaningless.

2) Another one is that U.S. economy peaks-out especially with tumbling equity price and housing market, if FED starts tightening apparently.

And then, where will it go from now?

We can think some scenarios.

I will post it soon...

Friday, October 30, 2015

Wednesday, October 28, 2015

Ahead of FOMC, someone requires clear signal for FED and another one argues FED has hurt investment

Hillsenrath in WSJ points unclear signals of FED to financial markets. And this time is to diminish uncertainty spreads. Main FED members has said possible rate hike soon, but bond rate rarely reflect expected trajectory by them.

Some surveys suggest FED chairwoman, Yellen's leadership is the worst than previous chairmen. Actually core members without Yellen in the inner circle seem to argue own opinions. They are Stanley Fischer, vice president of FED, and Mr. Dudley, the NY FED president.

They are unfamiliar each other? Not at all. Hillsenrath suggests some evidences meaning their communications are very frequently. According to some people who know them, Ms. Yellen and Mr. Fischer have lunch every week and discuss the economy and strategy. Moreover, Mr. Dudley has often dialed to meetings with Ms. Yellen and Mr. Fischer and other senior staff members.

Nevertheless, they argue own views, so market has been very frustrated. For now, many participants call this as the uncertainty. Uncertainty is bad, because economic activities could be shrank on this. This is what Prime Minister in Indonesia has argued. So, Hillsenrath expresses this as there are three camps in FED, not one core circle.

Someone who argues clear signal of FED seems to want interest rate hike in December. They maybe believe U.S. economy is somewhat solid to increase rate more than zero and this could improve economic sentiments. They think rate hike could be positive news for risk assets including equity market rather than contracting markets.

On the other hand, we should think the rationale why FED core members are divided.

Nowotny, the member of ECB, said central banks were weak at defeating deflation because their arms were optimal for fighting inflation. That seems the fact. It's very difficult to handle the monetary policy for central bank members.

Recently, however, the main focus move toward really effective policy tools, not depending on QE further more. Many governors and central bankers argue fiscal policy is needed, even though detail plans are not suggested.

Today an opinion article is published on last page with Hillsenrath's article previously commented on first page in WSJ. That opinion article is named "The FED has hurt U.S. business investment"

Albeit Ben Bernanke said the problem was that the absence of compelling investment opportunities in the real economy and this led to accommodative monetary policy, the author critics it is only true in the economic text book.

Business investment in the real U.S. economy is very weak. Growth in nonresidential fixed investment remains substantially lower than the last six post-recession expansions. Many believe that today's lack of capital investment in America stems from a shortfall of global demand.

However, business investment depends on future demand, not current demand. Old QEs suggested too limited signs for boosting investment. Why have main street and Wall street diverged during this period?

Authors argue that is because; 1) corporate decision makers can't be certain about the consequences of QE's unwinding on the real economy. This means QE has the limit by descent. 2) Financial assets are considerably more liquid than real assets. 3) QE reduces volatility in the financial markets, not the real economy. Consequently, financial asset prices have been robust by QE. So, they argue these trends, if not reversed, threaten to harm the U.S. economy's growth prospects.

Ironically, FED QEs underpinned U.S. economy especially in residential sector which had deteriorated massively and was a main cause of the crisis, so other developed countries have followed FED to conduct QE instruments. But, for now, the efficiency from QE is not working any more, many start to argue.

(But, Draghi, the president of ECB, announced the possible increase of QE in light of both of size and end-date last week. Why? Is he real? He suggested lower inflation as a cause, but inflation is very linked in oil price. And ECB's QE leads weakness of Euro, so oil price should tumble. What is the real purpose of him?)

If not now, Ms. Yellen must have a leadership for global economy and financial markets. Maybe increase in FED funds rate could improve economic sentiment including business investments. In current environment, excluding ECB, oil price seems to be pushed higher toward next year. This should enhance headline inflation in global toward higher and the worries about deflation could be diminished. At the end of this year or start of next year will be appropriate timing to start tightening. If can't, global economy would be very gloomy as U.S. economy turned to recession with the burden of housing markets and equity market prices...

According to Barclays Investors Survey, many participants have already tilted deflation scenario under vague and non confident FED stance. If Ms. Yellen starts to act, the opportunity would be in upside surprise of economy which means short long-end tenor duration...

.php)

Some surveys suggest FED chairwoman, Yellen's leadership is the worst than previous chairmen. Actually core members without Yellen in the inner circle seem to argue own opinions. They are Stanley Fischer, vice president of FED, and Mr. Dudley, the NY FED president.

They are unfamiliar each other? Not at all. Hillsenrath suggests some evidences meaning their communications are very frequently. According to some people who know them, Ms. Yellen and Mr. Fischer have lunch every week and discuss the economy and strategy. Moreover, Mr. Dudley has often dialed to meetings with Ms. Yellen and Mr. Fischer and other senior staff members.

Nevertheless, they argue own views, so market has been very frustrated. For now, many participants call this as the uncertainty. Uncertainty is bad, because economic activities could be shrank on this. This is what Prime Minister in Indonesia has argued. So, Hillsenrath expresses this as there are three camps in FED, not one core circle.

Someone who argues clear signal of FED seems to want interest rate hike in December. They maybe believe U.S. economy is somewhat solid to increase rate more than zero and this could improve economic sentiments. They think rate hike could be positive news for risk assets including equity market rather than contracting markets.

On the other hand, we should think the rationale why FED core members are divided.

Nowotny, the member of ECB, said central banks were weak at defeating deflation because their arms were optimal for fighting inflation. That seems the fact. It's very difficult to handle the monetary policy for central bank members.

Recently, however, the main focus move toward really effective policy tools, not depending on QE further more. Many governors and central bankers argue fiscal policy is needed, even though detail plans are not suggested.

Today an opinion article is published on last page with Hillsenrath's article previously commented on first page in WSJ. That opinion article is named "The FED has hurt U.S. business investment"

Albeit Ben Bernanke said the problem was that the absence of compelling investment opportunities in the real economy and this led to accommodative monetary policy, the author critics it is only true in the economic text book.

Business investment in the real U.S. economy is very weak. Growth in nonresidential fixed investment remains substantially lower than the last six post-recession expansions. Many believe that today's lack of capital investment in America stems from a shortfall of global demand.

However, business investment depends on future demand, not current demand. Old QEs suggested too limited signs for boosting investment. Why have main street and Wall street diverged during this period?

Authors argue that is because; 1) corporate decision makers can't be certain about the consequences of QE's unwinding on the real economy. This means QE has the limit by descent. 2) Financial assets are considerably more liquid than real assets. 3) QE reduces volatility in the financial markets, not the real economy. Consequently, financial asset prices have been robust by QE. So, they argue these trends, if not reversed, threaten to harm the U.S. economy's growth prospects.

Ironically, FED QEs underpinned U.S. economy especially in residential sector which had deteriorated massively and was a main cause of the crisis, so other developed countries have followed FED to conduct QE instruments. But, for now, the efficiency from QE is not working any more, many start to argue.

(But, Draghi, the president of ECB, announced the possible increase of QE in light of both of size and end-date last week. Why? Is he real? He suggested lower inflation as a cause, but inflation is very linked in oil price. And ECB's QE leads weakness of Euro, so oil price should tumble. What is the real purpose of him?)

If not now, Ms. Yellen must have a leadership for global economy and financial markets. Maybe increase in FED funds rate could improve economic sentiment including business investments. In current environment, excluding ECB, oil price seems to be pushed higher toward next year. This should enhance headline inflation in global toward higher and the worries about deflation could be diminished. At the end of this year or start of next year will be appropriate timing to start tightening. If can't, global economy would be very gloomy as U.S. economy turned to recession with the burden of housing markets and equity market prices...

According to Barclays Investors Survey, many participants have already tilted deflation scenario under vague and non confident FED stance. If Ms. Yellen starts to act, the opportunity would be in upside surprise of economy which means short long-end tenor duration...

Tuesday, October 27, 2015

Australia Confidence Sags as Mortgage rates Rise

Increases in variable mortgages are likely to lead central bank to cut its key rates...wsj said...

Really? Why mortgage rates soar? Not because of recovery or improvement of housing market?

Really? Why mortgage rates soar? Not because of recovery or improvement of housing market?

Sunday, October 25, 2015

China & Commodities Weekly Review (Oct. 26, 2015)

1. PBOC lowered interest rates and RRR ahead of 5th Plenum; to boost domestic economy...

- The PBOC cut loan and deposit benchmark rates a further 25 bps - with the 1Y loan benchmark down to 4.35% and the 1Y time deposit benchmark to 1.50% - citing deflationary pressures and a need for stronger monetary stimulus to lower real financing costs.

- The PBOC also reduced the reserve requirement by another 50 bps - to 17.5% for major banks - indicating uncertain conditions ahead for banking system liquidity, due partly to a decline in foreign reserves and partly to seasonal tightness in October from tax payments.

- This so-called "double cuts" is expected to spur roughly RMB 750 bn of liquidity into the banking system.

- The central bank also fully removed caps on deposit pricing.

2. PBOC could adjust FX rate again after November...

IP growth fell to 5.7% y/y from 6.1% in August, the weakest since March. Electricity output growth remained anaemic, at -3.1% y/y. Coupled with the -5.9% y/y PPI reading, it means nominal IP growth was -0.5% y/y...

3. Inclusion of CNY to SDR

- SC : $ 1 tn of 11.3 tn, global total FX reserves, could move to RMB assets

- BoA : expects 13% weight for SDR larger than sterling, 11.3%

- HSBC : expects 14% weight...

4. ... This could amplify risk appetite as economic worries in China ease further rather than fears increase...

5. Saudi Arabia Will Be Broke In 5 Years, IMF Predicts...

- The PBOC cut loan and deposit benchmark rates a further 25 bps - with the 1Y loan benchmark down to 4.35% and the 1Y time deposit benchmark to 1.50% - citing deflationary pressures and a need for stronger monetary stimulus to lower real financing costs.

- The PBOC also reduced the reserve requirement by another 50 bps - to 17.5% for major banks - indicating uncertain conditions ahead for banking system liquidity, due partly to a decline in foreign reserves and partly to seasonal tightness in October from tax payments.

- This so-called "double cuts" is expected to spur roughly RMB 750 bn of liquidity into the banking system.

- The central bank also fully removed caps on deposit pricing.

2. PBOC could adjust FX rate again after November...

IP growth fell to 5.7% y/y from 6.1% in August, the weakest since March. Electricity output growth remained anaemic, at -3.1% y/y. Coupled with the -5.9% y/y PPI reading, it means nominal IP growth was -0.5% y/y...

3. Inclusion of CNY to SDR

- SC : $ 1 tn of 11.3 tn, global total FX reserves, could move to RMB assets

- BoA : expects 13% weight for SDR larger than sterling, 11.3%

- HSBC : expects 14% weight...

4. ... This could amplify risk appetite as economic worries in China ease further rather than fears increase...

5. Saudi Arabia Will Be Broke In 5 Years, IMF Predicts...

Japan Economics Weekly Review (Oct. 26, 2015)

1. Japan's Exports and Imports Lose Momentum

Japan's goods exports and imports fell in September with imports falling faster thereby shrinking the trade deficit. Export trends show nominal exports weak on all horizons of one year and less, and declining on balance over six months and three months. Nominal imports have a different pattern but are substantially lower over 12 months and over three months.

2. So, USD/JPY soared to higher than 121 last week as expectations for additional QQE increase further especially with dovish ECB.

3. But Honda, the adviser for Abe, said additional easing of BOJ is not essential for now and if BOJ eases further that could be last one. He emphasized fiscal policy is more efficient...

Japan's goods exports and imports fell in September with imports falling faster thereby shrinking the trade deficit. Export trends show nominal exports weak on all horizons of one year and less, and declining on balance over six months and three months. Nominal imports have a different pattern but are substantially lower over 12 months and over three months.

2. So, USD/JPY soared to higher than 121 last week as expectations for additional QQE increase further especially with dovish ECB.

3. But Honda, the adviser for Abe, said additional easing of BOJ is not essential for now and if BOJ eases further that could be last one. He emphasized fiscal policy is more efficient...

Europe Economics Weekly Review (Oc. 26, 2015)

- President Draghi surprised with a dovish “work and assess” stance.

- But, yield curve will move toward steepening...

- U.K. sales data upbeats while the woes about next year remains...

---------------------------------

1. President Draghi surprised with a dovish “work and assess” stance.

Some market participants start to revise year-end targets of yield and EUR/USD. Some researchers of short-bias in bond markets lowered year-end target in both of U.S. and Europe while remain recommendation to short duration.

He may have considered recently weak trade data contributing negative in growth.

2. EMU Trade Surplus Contracts in August

The EMU trade surplus contracted sharply in August, falling by 2.5 billion euros month-to-month. Still, the surplus is smartly higher year-over-year. Both exports and imports are losing momentum.

3. But, yield curve will move toward steepening under expectation of lowering policy rate and upcoming higher inflation rate. So, after December ECB meeting, even though they lower deposit rate by 10bps and expand both of the size and period for QE as he pursues overshooting, market participants may recognize it as a last thing... So, some argues German bunds 10 year yield will soar...

4. Manufacturing in Europe has come up lame again in October, but upbeats market expectation.

5. U.K. retail sales surged in September, rising by 1.4% after a 0.8% August decline

Clothing and footwear sales remained weak in August as they fell by 1.8%, their second fall in three months. Food and beverage spending rose by 2.3% in September, but that was after two straight months of declines. Overall, however, sales have been much more consistent and consistently positive.

6. But, someone argues there may be slowdown next year as fiscal policy tightens and strong sterling bites...

- But, yield curve will move toward steepening...

- U.K. sales data upbeats while the woes about next year remains...

---------------------------------

1. President Draghi surprised with a dovish “work and assess” stance.

Some market participants start to revise year-end targets of yield and EUR/USD. Some researchers of short-bias in bond markets lowered year-end target in both of U.S. and Europe while remain recommendation to short duration.

He may have considered recently weak trade data contributing negative in growth.

2. EMU Trade Surplus Contracts in August

The EMU trade surplus contracted sharply in August, falling by 2.5 billion euros month-to-month. Still, the surplus is smartly higher year-over-year. Both exports and imports are losing momentum.

3. But, yield curve will move toward steepening under expectation of lowering policy rate and upcoming higher inflation rate. So, after December ECB meeting, even though they lower deposit rate by 10bps and expand both of the size and period for QE as he pursues overshooting, market participants may recognize it as a last thing... So, some argues German bunds 10 year yield will soar...

4. Manufacturing in Europe has come up lame again in October, but upbeats market expectation.

5. U.K. retail sales surged in September, rising by 1.4% after a 0.8% August decline

Clothing and footwear sales remained weak in August as they fell by 1.8%, their second fall in three months. Food and beverage spending rose by 2.3% in September, but that was after two straight months of declines. Overall, however, sales have been much more consistent and consistently positive.

6. But, someone argues there may be slowdown next year as fiscal policy tightens and strong sterling bites...

U.S. Economics Weekly Review (Oct. 26, 2015)

- Housing index was almost solid while upward momentum of price somewhat eased

- Manufacturing indexes including regional Feds' slightly bottomed-up with external fears decreased

- 3Q GDP will be released ahead of FOMC... market expects 1.5%...

----------------------------------------------------------------

1. Housing index was almost solid while upward momentum of price somewhat eased

(1) U.S. Home Builders Index Strengthens to 10-Year High

The Composite Housing Market Index from the National Association of Home Builders-Wells Fargo increased 4.9% to 64 (18.5% y/y) from a downwardly revised September level of 61. It was the highest level since October 2005 and beat expectations for 62 in the Informa Global Markets Survey. The NAHB figures are seasonally adjusted.

(2) U.S. Housing Starts Post Firm Gain but Building Permits Ease

Housing starts during September increased 6.0% to 1.206 million (AR) from 1.132 million in August, last month reported as 1.126 million. During all of the third quarter, starts inched 0.5% higher versus Q2. The latest figure surpassed expectations for 1.131 million starts in the Action Economics Forecast Survey.

(3) U.S. Existing Home Sales Rebound as Prices Fall Again

Sales of existing homes increased 4.7% (8.8% y/y) during September to 5.550 million and recouped the August decline to 5.300 million, revised from 5.310 million.

2. Manufacturing indexes including regional Feds' slightly bottomed-up with external fears decreased

(1) U.S. Markit Manufacturing PMI turned up this month with robust new orders index

(2) Philadelphia Fed Nonmanufacturing Survey Indicates Improvement

(3) Kansas City Federal Reserve Factory Sector Index Improves

... Manufacturing’s soft spot will end with a short-cycle.

Global manufacturing has stagnated this year, expanding at a less-than-1% annualized pace. Three developments should promote a rebound toward 2.5% growth. First, we expect tech activity to pickup, helped in part by a year-end product cycle for mobile devices.

Second, we expect rising global tech and consumer demand to allow companies to slow stock-building, removing a recent drag on manufacturing output. Finally, a sharp slowing in China’s industrial sector should end as policy supports consumer and infrastructure spending.

3. U.S. Initial Jobless Insurance Claims Remain Near 1973 Low

Initial claims for unemployment insurance notched higher during the week ended October 15 to 259,000 from 256,000 during the prior week, revised from 255,000.

4. U.S. Leading Economic Index Declines... but, seems old fashioned...

It seems that components in leading, coincident, and lagging economic indexes are old fashioned maybe as economic structures change after financial crisis...

- Manufacturing indexes including regional Feds' slightly bottomed-up with external fears decreased

- 3Q GDP will be released ahead of FOMC... market expects 1.5%...

----------------------------------------------------------------

1. Housing index was almost solid while upward momentum of price somewhat eased

(1) U.S. Home Builders Index Strengthens to 10-Year High

The Composite Housing Market Index from the National Association of Home Builders-Wells Fargo increased 4.9% to 64 (18.5% y/y) from a downwardly revised September level of 61. It was the highest level since October 2005 and beat expectations for 62 in the Informa Global Markets Survey. The NAHB figures are seasonally adjusted.

(2) U.S. Housing Starts Post Firm Gain but Building Permits Ease

Housing starts during September increased 6.0% to 1.206 million (AR) from 1.132 million in August, last month reported as 1.126 million. During all of the third quarter, starts inched 0.5% higher versus Q2. The latest figure surpassed expectations for 1.131 million starts in the Action Economics Forecast Survey.

| Housing Starts (000s, SAAR) | Sep | Aug | Jul | Sep Y/Y % | 2014 | 2013 | 2012 |

|---|---|---|---|---|---|---|---|

| Total | 1,206 | 1,132 | 1,152 | 17.8 | 1,001 | 928 | 784 |

| Single-Family | 740 | 738 | 759 | 11.1 | 647 | 620 | 537 |

| Multi-Family | 466 | 394 | 393 | 28.7 | 354 | 308 | 247 |

| Starts By Region | |||||||

| Northeast | 137 | 111 | 160 | 28.7 | 110 | 97 | 80 |

| Midwest | 137 | 156 | 171 | -18.0 | 159 | 149 | 129 |

| South | 621 | 617 | 556 | 23.0 | 497 | 467 | 400 |

| West | 311 | 248 | 265 | 30.0 | 236 | 217 | 175 |

| Building Permits | 1,103 | 1,161 | 1,130 | 4.4 | 1,052 | 987 | 829 |

(3) U.S. Existing Home Sales Rebound as Prices Fall Again

Sales of existing homes increased 4.7% (8.8% y/y) during September to 5.550 million and recouped the August decline to 5.300 million, revised from 5.310 million.

| Existing Home Sales (SAAR, 000s) | Sep | Aug | Jul | Y/Y % | 2014 | 2013 | 2012 |

|---|---|---|---|---|---|---|---|

| Total | 5,550 | 5,300 | 5,580 | 8.8 | 4,920 | 5,074 | 4,657 |

| Northeast | 760 | 700 | 700 | 11.8 | 640 | 658 | 596 |

| Midwest | 1,310 | 1,280 | 1,300 | 12.0 | 1,131 | 1,194 | 1,063 |

| South | 2,210 | 2,130 | 2,290 | 5.7 | 2,048 | 2,032 | 1,834 |

| West | 1,270 | 1,190 | 1,290 | 9.5 | 1,102 | 1,190 | 1,163 |

| Single-Family Sales | 4,930 | 4,680 | 4,950 | 9.6 | 4,334 | 4,473 | 4,125 |

| Median Price Total ($, NSA) | 221,900 | 228,500 | 231,800 | 6.1 | 206,708 | 195,667 | 175,433 |

2. Manufacturing indexes including regional Feds' slightly bottomed-up with external fears decreased

(1) U.S. Markit Manufacturing PMI turned up this month with robust new orders index

(2) Philadelphia Fed Nonmanufacturing Survey Indicates Improvement

(3) Kansas City Federal Reserve Factory Sector Index Improves

... Manufacturing’s soft spot will end with a short-cycle.

Global manufacturing has stagnated this year, expanding at a less-than-1% annualized pace. Three developments should promote a rebound toward 2.5% growth. First, we expect tech activity to pickup, helped in part by a year-end product cycle for mobile devices.

Second, we expect rising global tech and consumer demand to allow companies to slow stock-building, removing a recent drag on manufacturing output. Finally, a sharp slowing in China’s industrial sector should end as policy supports consumer and infrastructure spending.

3. U.S. Initial Jobless Insurance Claims Remain Near 1973 Low

Initial claims for unemployment insurance notched higher during the week ended October 15 to 259,000 from 256,000 during the prior week, revised from 255,000.

4. U.S. Leading Economic Index Declines... but, seems old fashioned...

It seems that components in leading, coincident, and lagging economic indexes are old fashioned maybe as economic structures change after financial crisis...

| Business Cycle Indicators (%) | Sep | Aug | Jul | Sep Y/Y | 2014 | 2013 | 2012 |

|---|---|---|---|---|---|---|---|

| Leading | -0.2 | 0.0 | 0.0 | 3.4 | 5.8 | 3.3 | 2.1 |

| Coincident | 0.2 | 0.1 | 0.3 | 2.2 | 2.5 | 1.9 | 2.6 |

| Lagging | 0.5 | 0.1 | 0.4 | 4.0 | 3.8 | 3.8 | 3.1 |

Friday, October 23, 2015

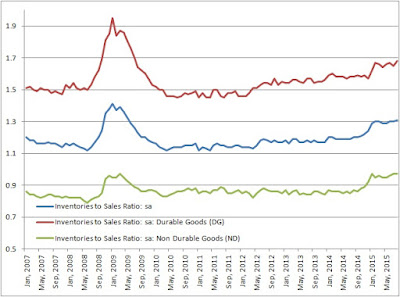

U.S. high inventory/sales ratio - Details

As considering economic headwinds from high inventory / sales ratio, let's see the wholesalers' data, seasonally adjusted, which contributes GDP growth mainly.

(1) Inventory ratio of non-durable goods is relatively lower than durable goods due to timely production process... Durable goods' have raised total ratio... This part is a main problem...

(2) In light of a big influence by durable goods and maybe adjustment seasonally... seasonal effect ahead of Thanks giving day seems not significant on total ratio number...

(3) Recently, however, total ratio has been raised by non-durable goods ratio near previous high at 2009, although absolute ratio is not high... This means deteriorating of manufacturing in short-cycle, or a little bit is likely.

The details in durable goods ratio...

(4) Construction materials ratio soared recently maybe with positive property market. Unless residential economy is solid as expected by some economists, this could a main headwind next year...

(5) Metal and mineral ratio recorded 2nd high...

(6) Auto inventory/sales ratio has soared with robust car sales... but, this would be a burden in car manufacturers apparently for next year... it's why U.S. tries to kill Volkswagen ?

In non durable goods...

(7) Apparel and chemicals ratio show upward trend, while apparel ratio is near the high in right after the financial crisis...

(8) Petroleum ratio is the lowest...

U.S. Employment : BLS household survey vs. Payroll survey

Via BLS report, "Employment from the BLS household and payroll surveys: summary of recent trends", Oct.2, 2015.

Both the payroll and household surveys are needed for a complete picture of the labor market. The payroll survey provides a highly reliable gauge of monthly change in nonfarm payroll employment. The household survey provides a broader picture of employment including agriculture and the self-employed.

For research and comparison purposes, BLS creates an “adjusted” household survey employment

series (red line) that is more similar in concept and definition to payroll survey employment. The

adjusted household survey employment series is calculated by subtracting from total employment

agriculture and related employment, nonagricultural self-employed, unpaid family and private

household workers, and workers absent without pay from their jobs, and then adding

nonagricultural wage and salary multiple jobholders. The resulting series is then seasonally

adjusted.

The main differences were created by...

(1) Sampling error - 143K vs. 60K

(2) Payroll survey benchmark revisions - Changing yearly, but somewhat lagged... Current benchmark of payroll data is based on March 2014.

(3) New business births - The payroll survey sample cannot include new firms immediately.

(4) Job Changing - If a person changes jobs and is on the payrolls of two employers during their pay periods that include the 12th of the month, both jobs would be counted in the payroll survey estimates.

Conclusion and Implications

(1) Considering possible error from somewhat old benchmark and excluding new birth jobs and self-employed in payroll data, recent labor market activities could not be disappointed as seasonal adjusted household surveys.

(2) However, seasonal adjustment has own volatility. Not adjusted data showed decline in employees.

(3) Furthermore, for recent 1 year, payroll jobs were more than household surveys'.

(4) Household surveys have own problem of small sampling like ECI data.

(5) So, it's hard to find meaningful implication from this...-_-

Both the payroll and household surveys are needed for a complete picture of the labor market. The payroll survey provides a highly reliable gauge of monthly change in nonfarm payroll employment. The household survey provides a broader picture of employment including agriculture and the self-employed.

For research and comparison purposes, BLS creates an “adjusted” household survey employment

series (red line) that is more similar in concept and definition to payroll survey employment. The

adjusted household survey employment series is calculated by subtracting from total employment

agriculture and related employment, nonagricultural self-employed, unpaid family and private

household workers, and workers absent without pay from their jobs, and then adding

nonagricultural wage and salary multiple jobholders. The resulting series is then seasonally

adjusted.

The main differences were created by...

(1) Sampling error - 143K vs. 60K

(2) Payroll survey benchmark revisions - Changing yearly, but somewhat lagged... Current benchmark of payroll data is based on March 2014.

(3) New business births - The payroll survey sample cannot include new firms immediately.

(4) Job Changing - If a person changes jobs and is on the payrolls of two employers during their pay periods that include the 12th of the month, both jobs would be counted in the payroll survey estimates.

Conclusion and Implications

(1) Considering possible error from somewhat old benchmark and excluding new birth jobs and self-employed in payroll data, recent labor market activities could not be disappointed as seasonal adjusted household surveys.

(2) However, seasonal adjustment has own volatility. Not adjusted data showed decline in employees.

(3) Furthermore, for recent 1 year, payroll jobs were more than household surveys'.

(4) Household surveys have own problem of small sampling like ECI data.

(5) So, it's hard to find meaningful implication from this...-_-

Monday, October 19, 2015

USD/KRW

KRW had depreciated against USD despite robust C/A surplus, because of ...

1) divergence of monetary policy from U.S...

2) willingness of governors

3) capital outflows with deposits in RMB mainly...

4) CNY devalues...

5) NDF flows...

But, recently those have been reversed to be strong KRW... temporarily !!

1) divergence of monetary policy from U.S...

2) willingness of governors

3) capital outflows with deposits in RMB mainly...

4) CNY devalues...

5) NDF flows...

But, recently those have been reversed to be strong KRW... temporarily !!

China economic review weekly (Oct.19, 2015)

1. CPI and PPI (September 2015)

- The CPI inflation moderated to 1.6% y/y from 2.0%, as food inflation eased significantly.

- Pork prices saw 0.4% m/m rise, after a 7.7% increase in August and a 9.9% climb in July.

- Non-food inflation stayed intact at 1.0% y/y and core inflation eased a tenth to 1.6% y/y.

- The sequential decline in PPI narrowed to 0.4% from 0.8%, while y/y PPI was flat at -5.9%.

The CPI inflation moderated visibly in September as the rise in pork prices cooled amid

improving supply. The sequential PPI deflation narrowed, but y/y rate, at -5.9%, was still the

worst since late 2009, underscoring the persistent overhang of domestic overcapacity and

global commodity bear cycle. The subdued inflation report underscores the poor state of

aggregate demand. It opens the door wider for the PBOC to further relax monetary policy.

Another interest rate cut in Q4 is likely, given currency depreciation pressure has subsided for

now, and the central bank may take the opportunity to fully liberalize deposit rate, so as to

facilitate RMB’s inclusion into the SDR at the IMF review meetings in November.

2. China: External trade (September 2015)

- Exports growth improved to -3.7% y/y from -5.5% y/y, better than expected.

- Imports dived 20.4% y/y, the worst since H2 2009, on imported deflation and soft demand.

- Trade surplus stayed lofty at USD 60.3bn, up 95% y/y, typical recessionary improvement.

- Exports growth, at -1.9% y/y year to date, was undoubtedly a big culprit of the downturn.

Exports growth registered a small improvement in September. But it might be unsustainable

without signs of pickup in external demand or stronger competitiveness of Chinese exports.

The -1.9% exports growth in the first three quarters was the worst in the past 15 years, barring

the crisis-ravaged 2009. Undoubtedly languishing exports has been a culprit of the economic

downturn. That said, what the PBOC has done in the past two months suggests it does not

have the intention to depreciate the currency to bolster exports. Instead, in the near term, to

secure RMB’s inclusion into the SDR is the primary goal, and a stable exchange rate might be

the best option before the IMF SDR review in November.

3. China Sep Money Supply

via BNP,

The RMB 9.9trn new loans in the first three quarters have topped the annual size in 2014, reflecting larger quotas granted by the PBOC. TSF also grew robustly, amid the explosion in bond financing thanks to easier access to bond issue and money rushing to buy bond after the stock rout. TSF underestimates credit supply, as local government bond issue and ABS actually downsize banks’ loan book. Even without considering the understatement, outstanding TSF growth at 12% y/y, and M2 growth at 13.1% y/y, continued to outpace our estimated nominal GDP growth of 6.8% y/y in the first three quarters. That means, overall financial leverage of Chinese economy kept rising, and the efficiency of credit to generate growth continued to deteriorate.

4. Those were mixed signals... but, SHCOMP increased further last week... due to not too bad indicators with expectations for additional policies as Li commented...

5. This week, ahead of GDP and I.P... expect continuing sustainability of risk assets...

6. IBs are upgrading oil price forecast...! Barclays, last week...

(cf. GS = super cycle, BCA = solar...)

7. but, BDI seems somewhat cautious... albeit analysts argue the effect from China national holidays... needed to follow...!

- The CPI inflation moderated to 1.6% y/y from 2.0%, as food inflation eased significantly.

- Pork prices saw 0.4% m/m rise, after a 7.7% increase in August and a 9.9% climb in July.

- Non-food inflation stayed intact at 1.0% y/y and core inflation eased a tenth to 1.6% y/y.

- The sequential decline in PPI narrowed to 0.4% from 0.8%, while y/y PPI was flat at -5.9%.

The CPI inflation moderated visibly in September as the rise in pork prices cooled amid

improving supply. The sequential PPI deflation narrowed, but y/y rate, at -5.9%, was still the

worst since late 2009, underscoring the persistent overhang of domestic overcapacity and

global commodity bear cycle. The subdued inflation report underscores the poor state of

aggregate demand. It opens the door wider for the PBOC to further relax monetary policy.

Another interest rate cut in Q4 is likely, given currency depreciation pressure has subsided for

now, and the central bank may take the opportunity to fully liberalize deposit rate, so as to

facilitate RMB’s inclusion into the SDR at the IMF review meetings in November.

2. China: External trade (September 2015)

- Exports growth improved to -3.7% y/y from -5.5% y/y, better than expected.

- Imports dived 20.4% y/y, the worst since H2 2009, on imported deflation and soft demand.

- Trade surplus stayed lofty at USD 60.3bn, up 95% y/y, typical recessionary improvement.

- Exports growth, at -1.9% y/y year to date, was undoubtedly a big culprit of the downturn.

Exports growth registered a small improvement in September. But it might be unsustainable

without signs of pickup in external demand or stronger competitiveness of Chinese exports.

The -1.9% exports growth in the first three quarters was the worst in the past 15 years, barring

the crisis-ravaged 2009. Undoubtedly languishing exports has been a culprit of the economic

downturn. That said, what the PBOC has done in the past two months suggests it does not

have the intention to depreciate the currency to bolster exports. Instead, in the near term, to

secure RMB’s inclusion into the SDR is the primary goal, and a stable exchange rate might be

the best option before the IMF SDR review in November.

3. China Sep Money Supply

via BNP,

The RMB 9.9trn new loans in the first three quarters have topped the annual size in 2014, reflecting larger quotas granted by the PBOC. TSF also grew robustly, amid the explosion in bond financing thanks to easier access to bond issue and money rushing to buy bond after the stock rout. TSF underestimates credit supply, as local government bond issue and ABS actually downsize banks’ loan book. Even without considering the understatement, outstanding TSF growth at 12% y/y, and M2 growth at 13.1% y/y, continued to outpace our estimated nominal GDP growth of 6.8% y/y in the first three quarters. That means, overall financial leverage of Chinese economy kept rising, and the efficiency of credit to generate growth continued to deteriorate.

4. Those were mixed signals... but, SHCOMP increased further last week... due to not too bad indicators with expectations for additional policies as Li commented...

5. This week, ahead of GDP and I.P... expect continuing sustainability of risk assets...

6. IBs are upgrading oil price forecast...! Barclays, last week...

(cf. GS = super cycle, BCA = solar...)

7. but, BDI seems somewhat cautious... albeit analysts argue the effect from China national holidays... needed to follow...!

Japan economic review weekly (Oct.19, 2015)

1. Japan's Indices Wander in Different Directions

2. August I.P. was disappointed...

3. So, market participants expect additional asset purchase... but, BOJ and governors seem not...

4. USD/JPY swap points soared in September because of sell-off JGBs by PBOC ?

2. August I.P. was disappointed...

3. So, market participants expect additional asset purchase... but, BOJ and governors seem not...

4. USD/JPY swap points soared in September because of sell-off JGBs by PBOC ?

Europe economic review weekly (Oct. 19, 2015)

Fear about deteriorating vs. somewhat solid consumption (and current earnings path?)

1. EMU IP Clings to Growth But Decelerates

EMU industrial production excluding construction (IPxC) fell by 0.5% in August after a 0.8% increase in July.

Manufacturing IP fell by 0.3% and is weaker over three months falling at a 1% annualized pace.

2. France Shows Trade Flow Reversal

3. ZEW Careens Lower

ZEW financial experts cut their assessment of current conditions in the German economy and chopped their expectations as well. Expectations were cut by 10.2 points while the current situation index was slashed by 12.3 points. These are substantial drops. The future index drops by more month-to-month only 17% of the time. The current index drops by more month-to-month less than 9% of the time. Expectations fell sharply for two consecutive months and that cumulative drop has been larger only 9% of the time.

4. European Car Registrations Continue to Surge Higher Year-over-Year

The auto sales recovery has been able to carry both Europe and the U.S. to the recoveries they currently enjoy. But... can these sales continue on the torrid path they have had? Will slowing in auto sales slow retailing in general or will it be an opportunity for retail funds to matriculate into other sectors? Finally, will the problems with Volkswagen continue to significantly affect Germany?

5. ECB's Nowotny calls for new instruments to boost growth, inflation / Too early to talk of QE extension

"The ECB is using monetary policy instruments available but in my view it's quite obvious that ... additional sets of instruments are necessary. These include structural measures ... but also on the demand side of the economy and also on the institutional factors of the economy."

→ Nothing special is expected in ECB meeting this week...

→ Key theme for next year? Structural reform and fiscal expansion?

→ Set scenarios for investment strategies...!

6. In UK, CPI lowered -0.1% in September from previous month's +0.2%... and, jobless claims in September increased +4.6K despite the expectation of increase...

7. But, weekly earnings number was 2.8% suggesting somewhat solid growth...

→ mixed signals... in line with moderate improvement... but it's ahead of Brexit problem...

1. EMU IP Clings to Growth But Decelerates

EMU industrial production excluding construction (IPxC) fell by 0.5% in August after a 0.8% increase in July.

Manufacturing IP fell by 0.3% and is weaker over three months falling at a 1% annualized pace.

2. France Shows Trade Flow Reversal

3. ZEW Careens Lower

ZEW financial experts cut their assessment of current conditions in the German economy and chopped their expectations as well. Expectations were cut by 10.2 points while the current situation index was slashed by 12.3 points. These are substantial drops. The future index drops by more month-to-month only 17% of the time. The current index drops by more month-to-month less than 9% of the time. Expectations fell sharply for two consecutive months and that cumulative drop has been larger only 9% of the time.

4. European Car Registrations Continue to Surge Higher Year-over-Year

The auto sales recovery has been able to carry both Europe and the U.S. to the recoveries they currently enjoy. But... can these sales continue on the torrid path they have had? Will slowing in auto sales slow retailing in general or will it be an opportunity for retail funds to matriculate into other sectors? Finally, will the problems with Volkswagen continue to significantly affect Germany?

5. ECB's Nowotny calls for new instruments to boost growth, inflation / Too early to talk of QE extension

"The ECB is using monetary policy instruments available but in my view it's quite obvious that ... additional sets of instruments are necessary. These include structural measures ... but also on the demand side of the economy and also on the institutional factors of the economy."

→ Nothing special is expected in ECB meeting this week...

→ Key theme for next year? Structural reform and fiscal expansion?

→ Set scenarios for investment strategies...!

6. In UK, CPI lowered -0.1% in September from previous month's +0.2%... and, jobless claims in September increased +4.6K despite the expectation of increase...

7. But, weekly earnings number was 2.8% suggesting somewhat solid growth...

→ mixed signals... in line with moderate improvement... but it's ahead of Brexit problem...

Sunday, October 18, 2015

U.S. economic review weekly (Oct. 19, 2015)

U.S. government debt problem is expected to be normalized if economic expansion continues...

1. U.S. Budget Deficit Shrinks to Eight-Year Low As Revenues Strengthen

The U.S. Treasury Department reported a $438.9 billion budget deficit during FY2015, narrower than the $483.4 billion deficit in FY2014. It was the smallest deficit since FY2007. As a percent of GDP, the roughly 2.5% was the least since 1.3%, also in 2007. The latest projection from the Congressional Budget Office calls for a deficit of $414 billion next year then $416 billion in 2017. → it's near sustainable point...

But, manufacturers seem cautious...

2. U.S. Industrial Production Continues to Soften

Overall industrial output eased 0.2% during September (+0.4% y/y) following a 0.1% dip in August, last month reported as -0.4%. The latest decline matched expectations in the Action Economics Forecast Survey. Manufacturing sector production dipped 0.1 % (+1.3% y/y) following a 0.4% fall. Mining output was off 2.0% (-5.7 % y/y), the most since May. Utility output gained 1.3% (1.0% y/y) for a second straight month.

3. Philadelphia Fed Business Conditions Remains Below Break-Even

4. Empire State Factory Sector Activity Continues Lower

5. U.S. Business Inventories Remain Unchanged

...while labor market continues to improve...

6. U.S. Initial Claims For Unemployment Insurance Touch 1973 Low

The job market continues to strengthen. Initial claims for unemployment insurance declined to 255,000 (-6.8% y/y) during the week ended October 10 from a little-revised 262,000 during the prior week. The figure matched the lowest point since November 1973. The four week moving average of claims eased to 265,000.

7. U.S. JOLTS: Job Openings Rate Declines; Hiring Rate Remains Stable

The job openings rate declined to 3.6% during August from July's cycle-high of 3.8%. It nevertheless remained up versus 3.4% one year earlier. The job openings rate is the number of job openings on the last business day of the month as a percent of total employment plus job openings.

The key factor or tipping point is the price suggesting possible increase of nominal indicators, albeit recent trend follows pessimistic trajectories...

8. U.S. CPI Dips; Core Prices Strengthen

9. U.S. Retail Sales Are Little Changed Again...

10. NABE Lowers Real Growth and Inflation Forecasts

The National Association for Business Economics forecast of 2.7% growth in U.S. real economic activity in 2016 was revised from 2.9% posted in June. Expected growth of 2.5% this year, however, was little-changed.

... seems too optimistic amid high residential growth and car sales...

1. U.S. Budget Deficit Shrinks to Eight-Year Low As Revenues Strengthen

The U.S. Treasury Department reported a $438.9 billion budget deficit during FY2015, narrower than the $483.4 billion deficit in FY2014. It was the smallest deficit since FY2007. As a percent of GDP, the roughly 2.5% was the least since 1.3%, also in 2007. The latest projection from the Congressional Budget Office calls for a deficit of $414 billion next year then $416 billion in 2017. → it's near sustainable point...

| US Government Finance | FY'15 | FY'14 | FY'13 | FY'12 | |

|---|---|---|---|---|---|

| Budget Balance | -- | $438.9 bil. | $483.4 bil. | $-680.2 bil. | $-1,089.2 bil. |

| As a percent of GDP | -- | 2.5 | 2.8 | 4.1 | 6.8 |

| % of Total | |||||

| Net Revenues (Y/Y % Change) | 100 | 7.6% | 8.9% | 13.3% | 6.4% |

| Individual Income Taxes | 47 | 10.5 | 5.9 | 16.3 | 3.7 |

| Corporate Income Taxes | 11 | 7.2 | 17.3 | 12.9 | 33.8 |

| Social Insurance Taxes | 33 | 4.1 | 8.0 | 12.1 | 3.2 |

| Excise Taxes | 3 | 5.3 | 11.1 | 6.3 | 9.2 |

| Net Outlays (Y/Y % Change) | 100 | 5.2 | 1.4 | -2.4 | -1.7 |

| National Defense | 16 | -2.3 | -4.7 | -6.3 | -3.9 |

| Health | 13 | 17.8 | 14.3 | 3.3 | -7.0 |

| Medicare | 15 | 6.7 | 2.8 | 5.5 | -2.8 |

| Income Security | 14 | -0.9 | -4.3 | -1.1 | -9.1 |

| Social Security | 24 | 4.4 | 4.5 | 5.2 | 5.8 |

| Veterans Benefits & Services | 4 | 6.8 | 7.7 | 11.5 | -2.0 |

| Education, Training, Employment & Social Services | 3 | 34.7 | 25.9 | -21.9 | -10.3 |

| Interest | 6 | -1.8 | 2.8 | 0.4 | -3.0 |

But, manufacturers seem cautious...

2. U.S. Industrial Production Continues to Soften

Overall industrial output eased 0.2% during September (+0.4% y/y) following a 0.1% dip in August, last month reported as -0.4%. The latest decline matched expectations in the Action Economics Forecast Survey. Manufacturing sector production dipped 0.1 % (+1.3% y/y) following a 0.4% fall. Mining output was off 2.0% (-5.7 % y/y), the most since May. Utility output gained 1.3% (1.0% y/y) for a second straight month.

| Industrial Production (SA, % Change) | Sep | Aug | Jul | Sep Y/Y | 2014 | 2013 | 2012 |

|---|---|---|---|---|---|---|---|

| Total Output | -0.2 | -0.1 | 0.8 | 0.4 | 3.7 | 1.9 | 2.8 |

| Manufacturing | -0.1 | -0.4 | 1.0 | 1.3 | 2.5 | 0.9 | 2.7 |

| Consumer Goods | 0.2 | -0.4 | 1.6 | 2.7 | 2.2 | 1.5 | -1.3 |

| Business Equipment | -0.1 | 0.6 | 0.1 | 1.8 | 4.8 | -0.4 | 9.9 |

| Construction Supplies | -1.3 | 0.3 | 0.4 | 0.1 | 3.9 | 2.8 | 4.3 |

| Materials | -0.3 | -0.5 | 0.6 | -0.3 | 5.1 | 3.1 | 4.1 |

| Utilities | 1.3 | 1.3 | -1.4 | 1.0 | 1.0 | 2.5 | -2.1 |

| Capacity Utilization (%) | 77.5 | 77.8 | 78.0 | 78.2 | 78.1 | 76.7 | 76.7 |

| Manufacturing | 75.9 | 78.1 | 76.4 | 75.7 | 75.3 | 74.0 | 74.5 |

3. Philadelphia Fed Business Conditions Remains Below Break-Even

4. Empire State Factory Sector Activity Continues Lower

5. U.S. Business Inventories Remain Unchanged

...while labor market continues to improve...

6. U.S. Initial Claims For Unemployment Insurance Touch 1973 Low

The job market continues to strengthen. Initial claims for unemployment insurance declined to 255,000 (-6.8% y/y) during the week ended October 10 from a little-revised 262,000 during the prior week. The figure matched the lowest point since November 1973. The four week moving average of claims eased to 265,000.

7. U.S. JOLTS: Job Openings Rate Declines; Hiring Rate Remains Stable

The job openings rate declined to 3.6% during August from July's cycle-high of 3.8%. It nevertheless remained up versus 3.4% one year earlier. The job openings rate is the number of job openings on the last business day of the month as a percent of total employment plus job openings.

8. U.S. CPI Dips; Core Prices Strengthen

9. U.S. Retail Sales Are Little Changed Again...

| Retail Spending (%) | Sep | Aug | Jul | Sep Y/Y | 2014 | 2013 | 2012 |

|---|---|---|---|---|---|---|---|

| Total Retail Sales & Food Services | 0.1 | 0.0 | 0.8 | -5.6 | 3.9 | 3.7 | 5.0 |

| Excluding Autos | -0.3 | -0.1 | 0.6 | 5.2 | 3.1 | 2.7 | 4.1 |

| Non-Auto Less Gasoline, Building Supplies & Food Services | -0.1 | 0.2 | 0.5 | 3.4 | 3.3 | 2.7 | 3.6 |

| Retail Sales | 0.0 | -0.1 | 0.8 | 1.7 | 3.7 | 3.8 | 4.9 |

| Motor Vehicle & Parts | 1.7 | 0.4 | 1.5 | 8.7 | 7.5 | 8.3 | 9.0 |

| Retail Less Autos | -0.5 | -0.2 | 0.6 | -0.3 | 2.6 | 2.6 | 3.9 |

| Gasoline Stations | -3.2 | -2.0 | -1.0 | -20.0 | -2.7 | -0.7 | 4.3 |

| Food Service & Drinking Places Sales | 0.7 | 0.7 | 0.4 | 8.4 | 6.2 | 3.4 | 5.9 |

10. NABE Lowers Real Growth and Inflation Forecasts

The National Association for Business Economics forecast of 2.7% growth in U.S. real economic activity in 2016 was revised from 2.9% posted in June. Expected growth of 2.5% this year, however, was little-changed.

| National Association For Business Economics | 2016 | 2015 | 2014 | 2013 |

|---|---|---|---|---|

| Real GDP (% Chg. SAAR) | 2.7 | 2.5 | 2.4 | 1.5 |

| Personal Consumption Expenditures | 2.9 | 3.0 | 2.7 | 1.7 |

| Nonresidential Structures | 4.3 | -0.1 | 8.1 | 1.6 |

| Nonresidential Equipment | 5.0 | 3.0 | 5.8 | 3.2 |

| Residential Investment | 8.1 | 8.5 | 1.8 | 9.5 |

| Change in Real Business Inventories (Bil. $) | 60.4 | 94.7 | 68.0 | 61.4 |

| Real Net Exports (Bil. $) | -560.0 | -536.5 | -442.5 | -417.5 |

| Housing Starts (Mil. Units) | 1.28 | 1.12 | 1.00 | 0.92 |

| Light Vehicle Sales (Mil. Units) | 17.1 | 17.1 | 16.4 | 15.5 |

| Payroll Employment Average Monthly Change (000s) | 211 | 212 | 260 | 199 |

| Unemployment Rate (%) | 4.9 | 5.3 | 6.2 | 7.4 |

| Consumer Price Index (Y/Y %) | 2.0 | 0.3 | 1.6 | 1.5 |

| Fed Funds Rate (%, Year-End) | 1.38 | 0.35 | 0.13 | 0.13 |

| 10-Year Treasury Note (%, Year-End) | 3.00 | 2.40 | 2.17 | 3.04 |

... seems too optimistic amid high residential growth and car sales...

Subscribe to:

Comments (Atom)